Acker Markets Annual Report 2023

INTRODUCTION

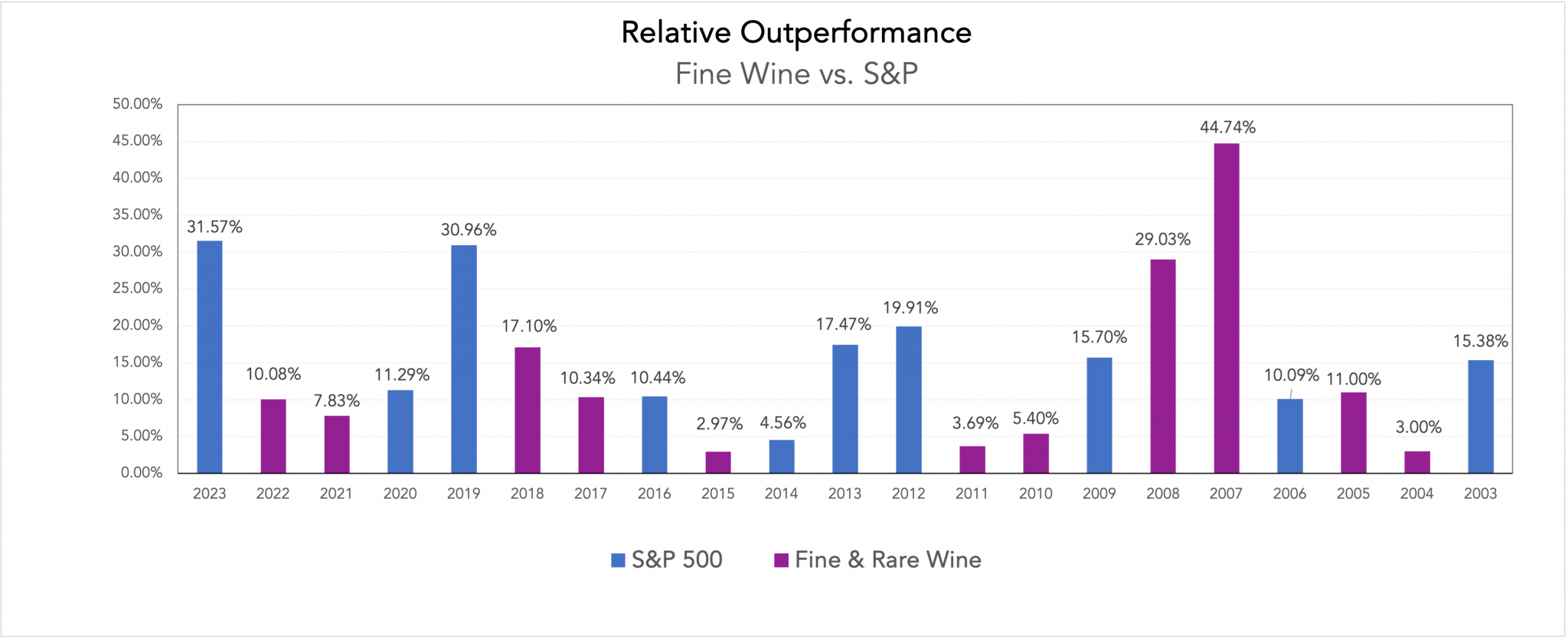

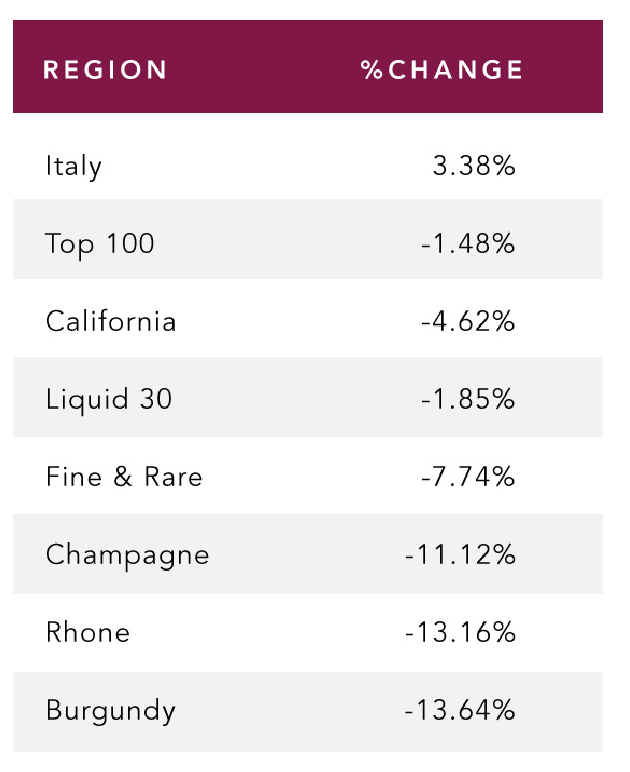

Last year indeed presented significant challenges for the wine market, with the Fine and Rare Index experiencing a decline of 7.74% in stark contrast to the S&P’s strong performance of 23.83%. This divergence marked the most substantial relative outperformance of stocks over wine in the past two decades. However, it is essential to recognize the inherent volatility in the relative performance of wine versus stocks, as illustrated by the historical data.

It is notable to recognize the relative performance volatility year over year between rare wine and equities of the past 20 years, with a long term average difference of only 1% between the Fine Wine Index & the S&P 500. The S&P 500’s 9.66% average annual return only slightly surpasses the Fine Wine Index’s 8.38% average annual return.

MARKET DYNAMICS

In 2023, the fine wine market was significantly influenced by both macro and microeconomic factors. Various events, such as the global increase in interest rates due to inflation, had a macro-level impact on the wine market. The most substantial influence, however, stemmed from the slowdown in the Chinese economy, affecting supply and demand across much of Asia. This led to an oversupply, particularly of young wine, creating distribution challenges worldwide.

Many in the distribution channel found themselves with excess inventory reflective past periods of high prices, causing a gradual depreciation in wine prices. High-end collectors who had received allocations at the market peak faced similar challenges. Hopes for a price rebound were dashed, resulting in a substantial liquidation of supplies in the second half of the year.

Remarkably, the global auction market experienced a 30% decline in volume from 2021, but lots offered for Burgundy and Bordeaux reached unprecedented levels in 2023, indicating a widespread selling trend. Private sales became a valuable means of discreetly liquidating high-end Burgundy and Bordeaux, contributing to a record year in our retail private sales division.

KEY PERFORMANCES FOR 2023

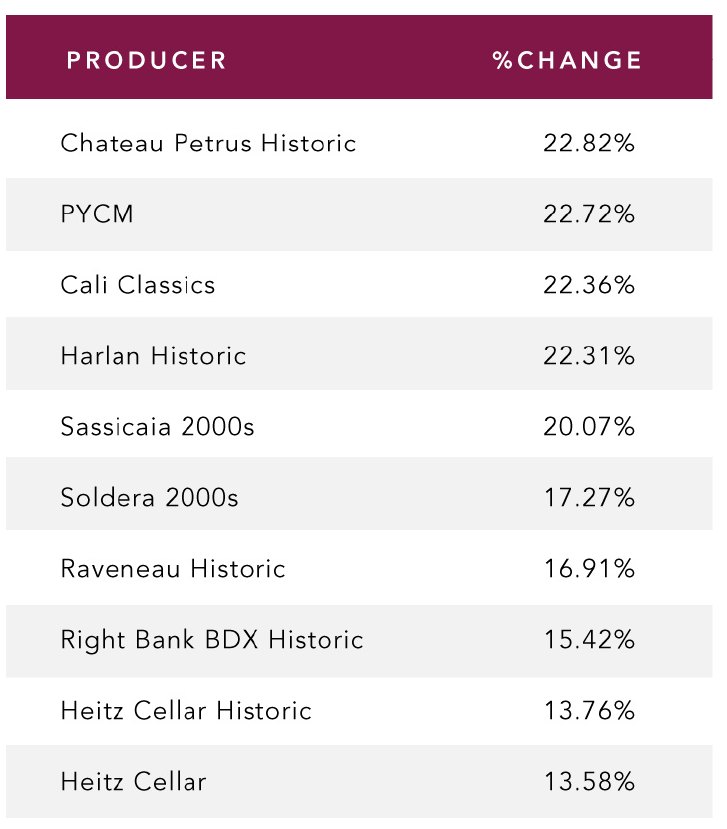

Marking the challenges faced throughout the year, the fourth quarter of 2023 witnessed the final capitulation for many, contributing to the reset of prices. Despite all obstacles, multiple indices demonstrated positive performances with double-digit returns across the wine world, from historic vintages of both Bordeaux and Burgundy, to the classic producers of California and Italy.

Top 10 Performing Wine Indices

Key Wine Indices Performance 2023

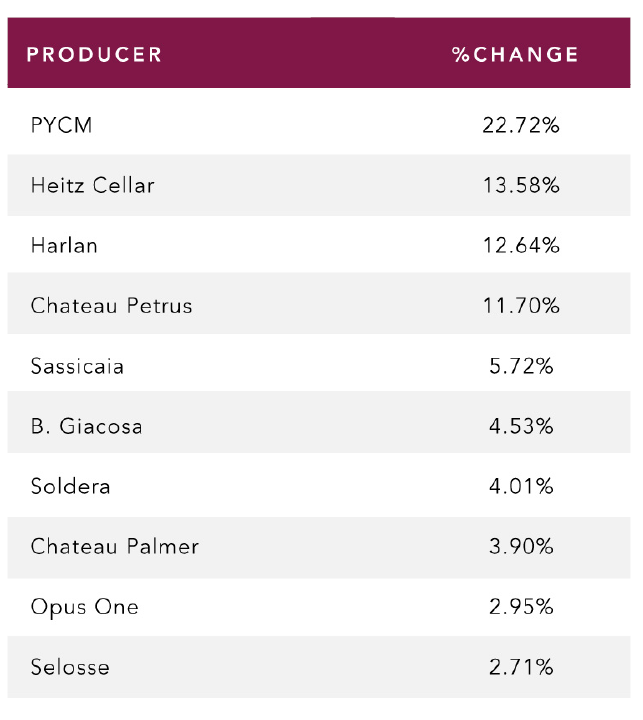

Top 10 Producer Indices Overall

The wines of Burgundian producer Pierre-Yves Colin-Morey demonstrated the best performance of the Top 10 Producers, making it the only Burgundy to occupy the Top Producer rankings in 2023.

Unique to recent quarters, California and Italy wine indices, namely the Cali Classics, multiple indices of Harlan and Heitz Cellar, and the more recent vintages of Italian producers Sassicaia, Soldera and Conterno occupied top positions in 2023 index performance, although variants were observed between historic and newer vintages.

Strong interest in pre-2000 wines, particularly in Bordeaux and California, accounted for 30% of the overall positions in the Top 10 Historic Indices, led by Chateau Petrus and Harlan.

Top 10 Performing Historic Indices*

*Historic Indices are comprised of a selection of the most traded wines from a given producer before the year 2000. The selection of wines and the index’s pricing scale are static as of the index’s creation date.

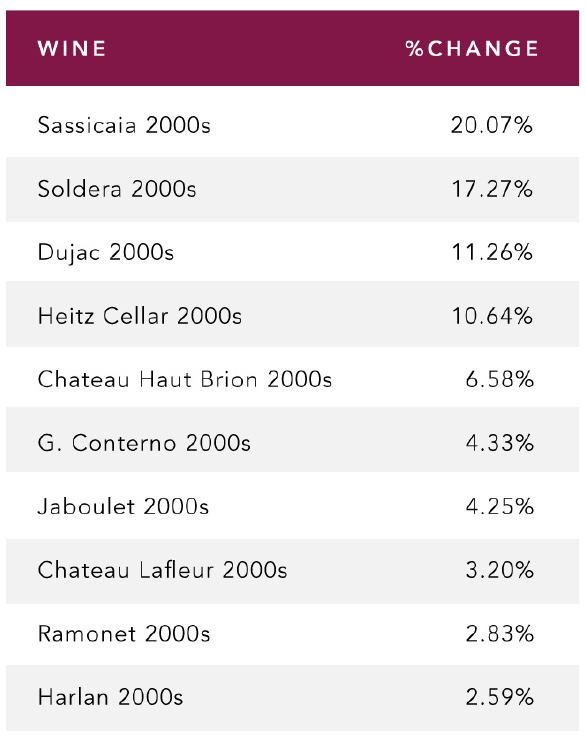

Top 10 Performing Vintage Indices 2000s*

*2000s Indices are comprised of a selection of the most traded wines from a given producer between the year 2000 and 2020. The selection of wines and index’s pricing scale are static as of the index’s creation date.

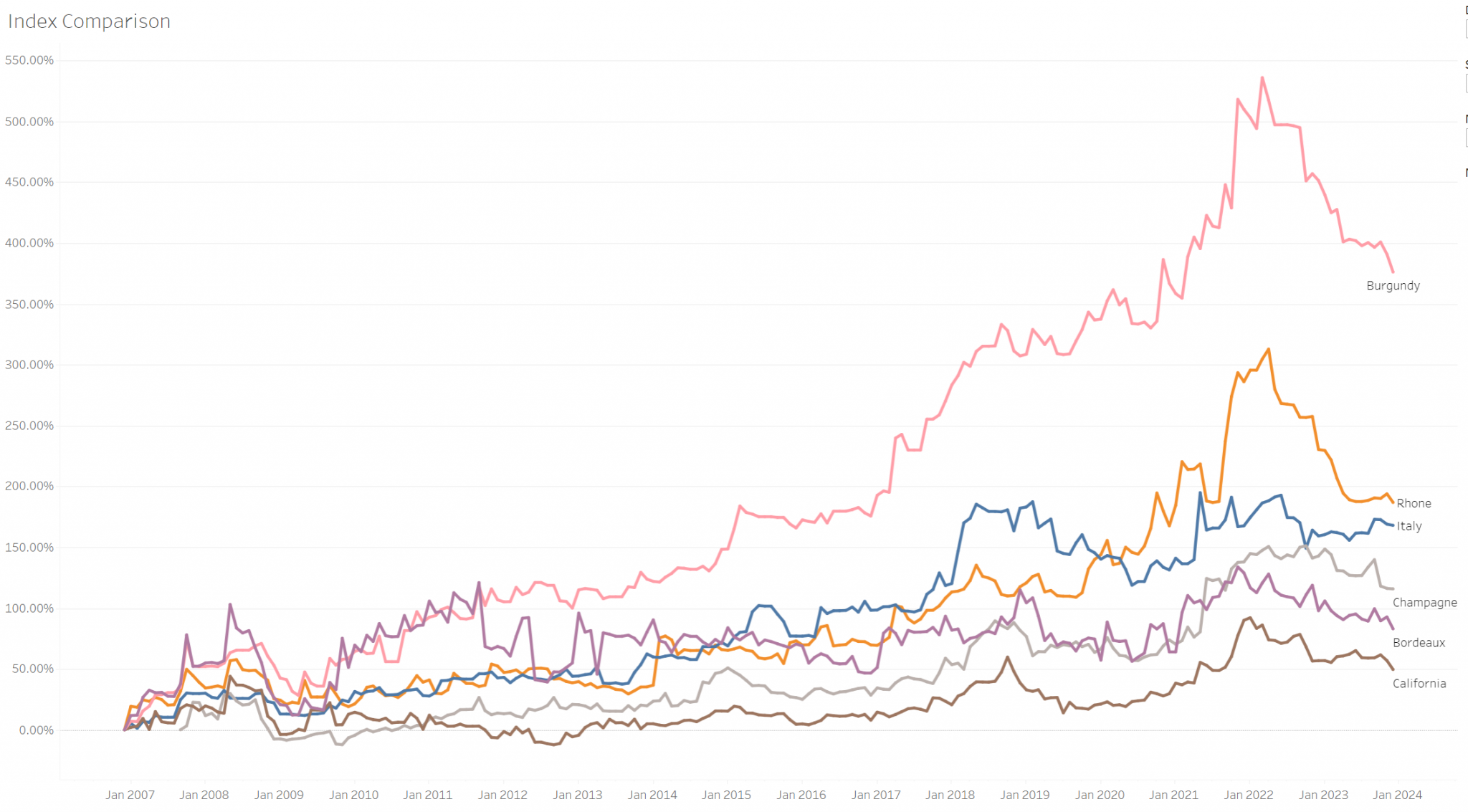

PERSPECTIVE: FROM COVID TO PRESENT

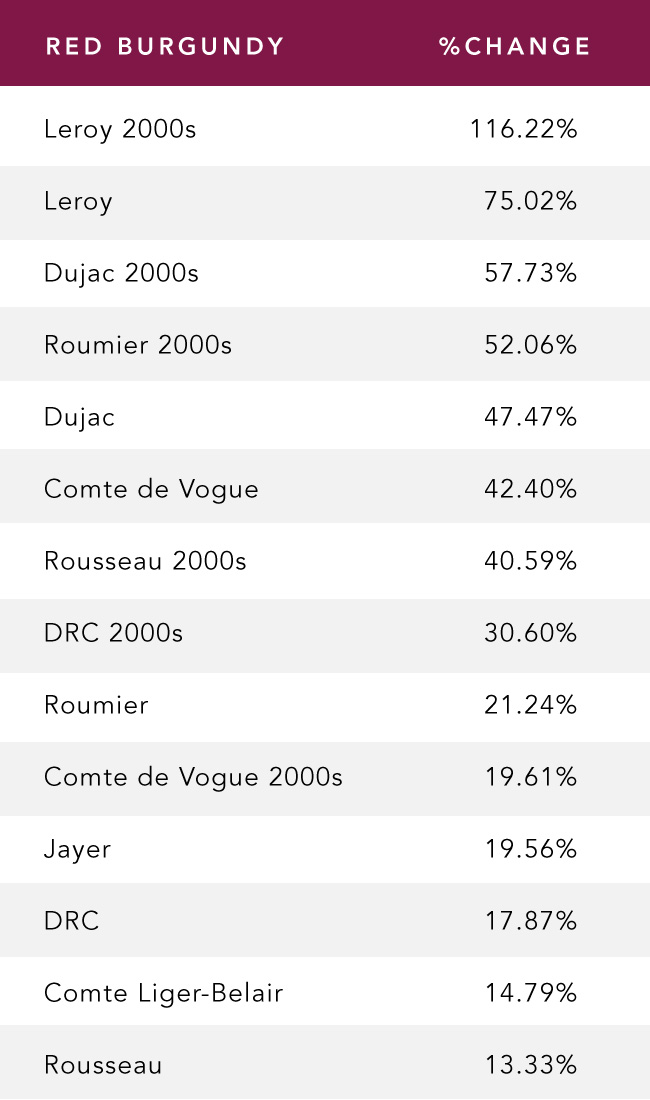

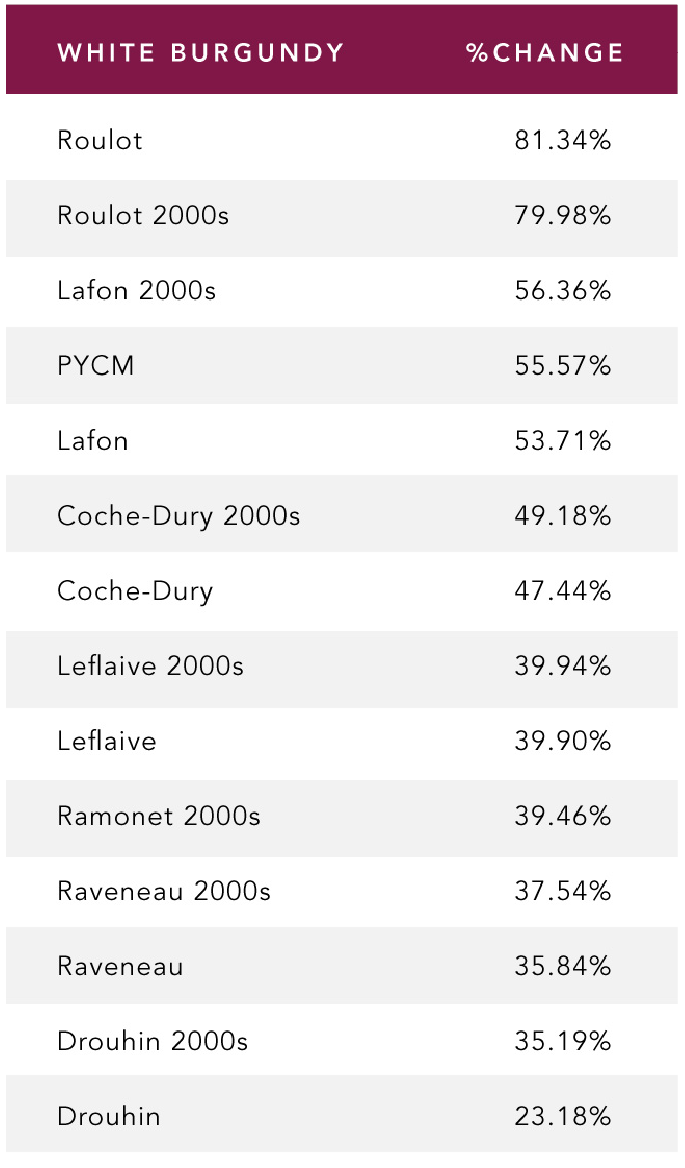

Despite the correction in market prices, many wine producers have experienced robust returns since the onset of COVID. This trend is evident across various regions and vintages, with some achieving double-digit returns, and in the case of the 2000s Leroy Index, triple-digit net returns.

Burgundy demonstrated the largest number of top performing indices in the pre to post-COVID period by far, for both red and white wines. Notably, the wines of Domaine Leroy occupied the top ranking overall, and the vintages between 2000 and 2020 performed particularly well.

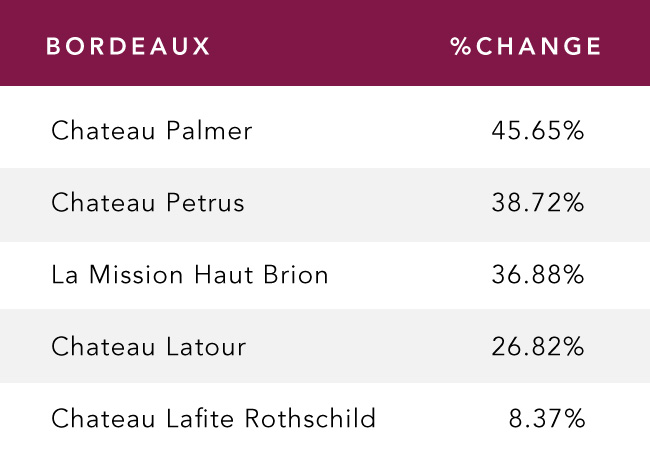

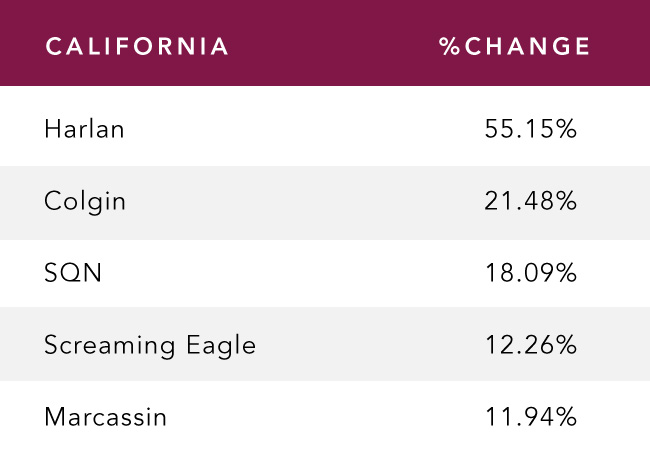

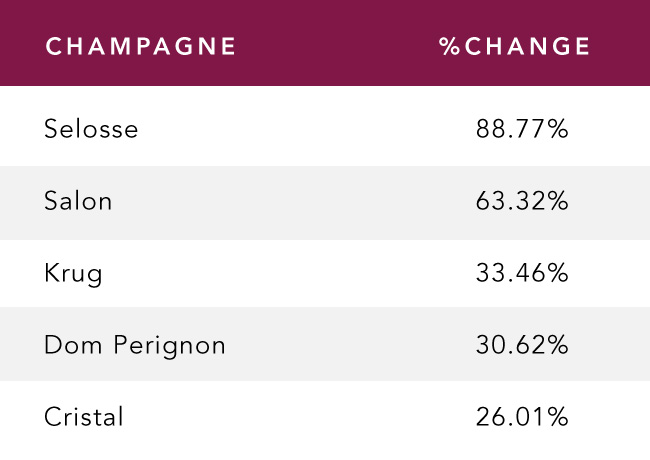

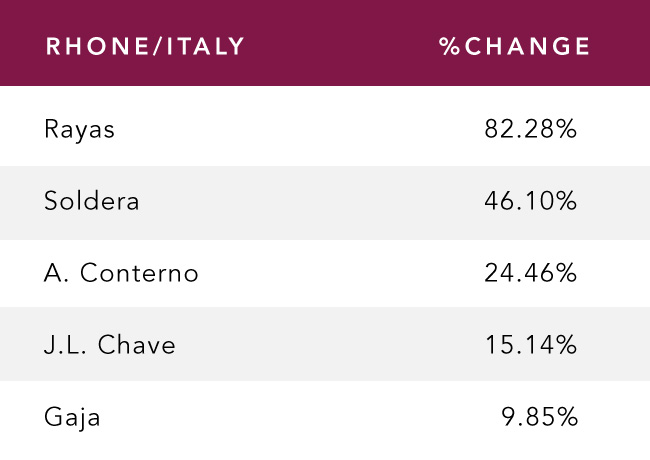

Outside of Burgundy, Champagne producers Selosse and Salon stood out, alongside the wines of Rayas from the Rhone - outperforming all other producers in their respective regions by almost 2x for the three year period.

Producer Indices Net Performance 2020-2023

Red & white burgundy

Producer Indices Net Performance 2020-2023

Bordeaux, california, Champagne, rhone & italy

Summary

We are optimistic that most market participants have acknowledged the correction of 2023, and we anticipate a more robust market environment in 2024. Overall, market conditions seem to indicate balance in the year ahead, where on one hand, those holding collections will look to capitalize on substantial gains from the past five years by selling; and on the other, collectors will seek to increase holdings pursuing the long-term positive returns that wine represents.

The buyer environment is expected to be discerning, yet positive. Indications from the Federal Reserve suggesting a lower future path of rates, and the strong possibility of a substantial and long-awaited Chinese stimulus package, could provide a healthy secondary tailwind to wine prices. Despite ongoing uncertainty in the geopolitical environment and the absence of a historical price pattern related to a US election year, we are eagerly anticipating a healthy and prosperous wine market in 2024.

IRVIN GOLDMAN

Chief Executive Officer